Later on in the afternoon at yesterday’s Startup Empire conference, Howard Lindzon took the stage. Howard manages a hedge fund and is the creator of the finance news humour site Wallstrip, which he sold to CBS in May 2007. He also has a very popular financial blog at HowardLindzon.com.

Later on in the afternoon at yesterday’s Startup Empire conference, Howard Lindzon took the stage. Howard manages a hedge fund and is the creator of the finance news humour site Wallstrip, which he sold to CBS in May 2007. He also has a very popular financial blog at HowardLindzon.com.

I shot some video asking Howard about his idea of “social leverage”; I’ll post it a litter later on. In the meantime, here are my notes from his presentation, Why Now is a Great Time to Start Your Startup.

The Current Situation

- Capital, which was so plentiful, is now gone

- Reminiscent of the real estate bubble in Phoenix (where I live half the time)

- Really important right now to shut out the noise

- From 2002 – 2006, it was fun to read Valleywag, TechCrunch and make "me too" products. You can’t do that anymore

- It’s also a bad time to base products on:

- Freemium

- Eyeballs

- Advertising

- Sometimes you have to shelf your ideas for when the times are more suitable for them

- The headlines are all doom and gloom these days:

- "Financial Ice Age" – BusinessWeek

- Startup Depression – Calacanis (I’m not a fan)

- You must remember that even during good times, 80 to 90% of businesses fail

- The VC model isn’t broken

Social Leverage

- Financial leverage has come home to roost

- We’re in a period of deleveraging: there is no bottom, because we don’t know what everyone owns

- P/E ratios — it’s all about expectation, people expect less

- You can’t get what you got six months ago

- Expectations are in "this ratchet-down mode"

- I also think that "we’re going into a depression" is crazy talk

- I’m anti-financial leverage

- Social leverage is all-powerful

- Nothing you do in social leverage will haunt you

- It’s a gift from the likes of Facebook, LinkedIn, Twitter

- Perhaps you shouldn’t start building social leverage with a blog unless your passion is for writing

- Start small: work with people

- Be mindful of the etiquette of social networking tools

- The time to ask people for something is when they’re least expecting it

Too Small to Fail

- Wall Street was all about "too big to fail"

- I’m not seeing signs from the presidents about being small – they seem too concerned with conglomerations and unwilling to bust up things

- Bailouts just prolong the process

- This is not a headline, it’s a state of being

- It’s a great time to start a web-based business

- If you’ve ever played the board game “Risk”, you know:

- If you’re starting all your armies in Europe, you’re screwed

- Start off in New Guinea

- Consider one of my projects, Stocktwits.com

- I like to stay in businesses I know

- Started in Twitter — thought it was dumb in the beginning

- Guys, this should be about ideas

- Wrote post about how there should be a message board for stocks using the reputation model in Twitter

- Twitter allows you some sort of reputation — everything you say is there for people to see

- Stocktwits — one employee, $30K to start

- Twitter offers possibilities: dating, betting — supports an ecosytem

- Be careful in whom you trust

- Embrace social leverage

- Be too small to fail: do the one thing you do very well

- Take as little money as you need; things will get better

- Ignore the people saying that this is “a new Ice Age” – they’re idiots

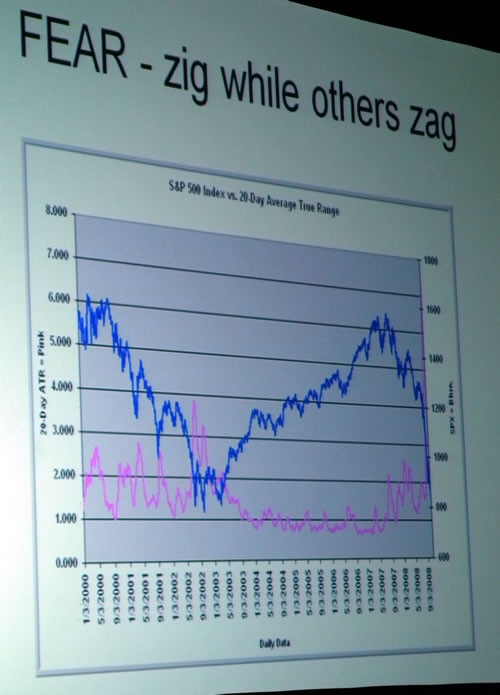

Fear

- Zig while others zag

- Take a look at this graph, in which the pink line is the Vicks index and the blue is RRSPs:

- From 2003 – 2005:

- Fear level low

- Calacanis’s company, TechCrunch and other stupid tech businesses wree founded when fear was low

- It’s always a good time to start a web business

- The truth is that it’s never a good time to start any business

- Successful business can be started anytime

- 80 – 90% of businesses fail anytime

Why businesses fail

- It’s important to have structure right from the beginning

- Mistakes made at start can come back to haunt you

- Sometimes partners fight, so rules and agreements at made at the the start are valuable

- The keys: Structure, funding and realistic valuation

- When it comes to spreadsheets and plans, keep in mind that it’s important to do one thing, do it well and get that customer – this is far more important than the spreadsheets

- Make sure you’re fishing where the fish are

- “Swim near the shark”

- Be around certain ecosystems

My Advice

- Social leverage: good

- Financial leverage: bad

- Be an expert at something

- For good or bad: mine is finance

- "I don’t really like the people in my industry"

- Applications of my expertise:

- Wallstrip: Its purpose was to lay humour on Wall Street

- MyTrade: sold to Investools

- and, as mentioned earlier, StockTwits

Q & A

How do you balance your day?

- StockTwits is the only thing I run

- Knightsbridge pays me to be on the road

- I’m usually up at 5am

- Private equity: long hours, long weekends

How do you make use of social leverage?

- One example: Fred Wilson

- Two months invested in reading his blog

- I found out that Fred was a basketball fan and took him to a Phoenix Suns game

- We talked business

- Fred just happened to be friends with Jim Cramer

- Through Fred, I met everybody else — I counts it as my “real day 1 “

- “You make your own luck”

What are you looking for with companies?

- I’m more of an angel and a scrapper

- I want to to be early

- I want to see a finished product

4 replies on “Howard Lindzon at Startup Empire: Why Now is a Good Time to Start Your Startup”

Phenomenal note-taking! You don’t by any chance sell a clone of yourself that will follow me around everywhere, do you?

[…] a final note, here’s a more extensive write-up on Howard’s […]

wow – thanks so much for capturing my thoughts on paper for me to improve upon. much appreciated

[…] scene expand. In November 2008 (the end of the world), he invited me to speak at a conference ‘Startup Empire’ with my topic ‘Why Now is a Good Time to Start a […]