In Apple and Samsung’s battle for the mobile market, truth is stranger than fiction

Click the photo to read the Vanity Fair article.

Vanity Fair’s Kurt Eichenwald, whom you probably remember from his August 2012 article on Microsoft’s wane in market share and influence under Steve Ballmer, has written a new article titled The Great Smartphone War. In the battle to own the hardware market for the next frontier in computing and communications, the stakes are high, the competition is fierce, the lawsuits are plenty, and sometimes, the story turns weird.

Eichewald’s earlier article showed Microsoft in a very unflattering light, but it seems like a mild rebuke compared to the way Samsung looks in The Great Smartphone War. He paints a picture of a company formerly known for producing second-rate electronics rising to power through tactics such as price-fixing, bribery, patent violations, using countersuits as delaying tactics while they quietly took the market, creating near-faithful duplicates of competitors’ innovations, and in one case, eating evidence before letting Apple’s legal team come into an office to take depositions.

Are headsets the new deskphones?

Click the photo to read the article.

In What…No Deskphones? Barbara A. Grothe, the CEO of an independent IT and technology consultancy, writes about her recent experiences deplying Microsoft Lync as the primary voice communication tool at a couple of client offices. The only deskphones deployed were “a few hallway phones and conference star phones with full duplex speakerphones built in”; all other phone calls made or taken at employee desks were done via Lync running on their computers and wireless headsets. The CIOs at the client firms saw that between employees working outside the office and seeing employees using their own mobile phones at their desks, why bother spending money on deskphones?

Grothe’s consultancy didn’t simply give the employees unopened boxes of headsets and leave them on their own to figure them out. Instead, they made sure that each employee received a fully-charged headset, installed their corresponding dongles and software on their computers, and showed each employee how to use the headset during the installation process. They also made sure that the C-level executives were the first to try the Lync/headset combo; “If the CIO and President of this company can conduct business without a deskphone,” writes Grothe, “then the employee felt motivated to follow suit.”

The use of wireless headsets allowed employees to answer incoming calls even when they were up to 30 feet away from their desks. With this convenience came one issue: unlike deskphones, where you can simply pick up the handset and dial, you have to be logged into your machine first in order to place a call using this setup.

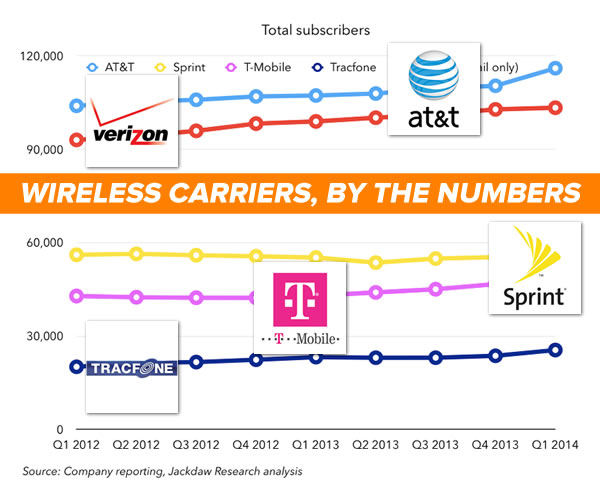

Wireless carrier stats: AT&T, Sprint, T-Mobile, Tracfone, and Verizon

Click the photo to read the article.

Jackdaw Research’s blog, Beyond Devices, maintains a running tally titled US Wireless Numbers that tracks the following figures released by the major wireless carriers as they report their quarterly results:

- Subscribers: AT&T has the most, followed in descending order by Verizon, Sprint, T-Mobile, then Tracfone. AT&T also has the largest proportion of wholesale and connected customers.

- Wireless revenue: Verizon makes the most — over $20 billion a quarter — followed in descending order by AT&T, Sprint, T-Mobile, and Tracfone.

- Operating margins: Verizon’s is the highest (nearly 40%), followed by AT&T and Tracfone. Sprint and T-Mobile have had the lowest operating margins over the past couple of years, with T-Mobile having recently traded places with Sprint and currently having the lowest (running about slightly below 0%).

- EBITDA margins: That’s Earnings Before Interest, Taxes, Depreciation, and Amortization, and from highest to lowest, it’s Verizon at about 45%, followed by AT&T (40%), Sprint (20%), T-Mobile, and Tracfone (both about 15%).

- Capital intensity: This refers to wireless capital expenditures as a fraction of wireless revenues. Here, the Big Four are within about 8% of each other, all between 10% and 20%, with AT&T spending the largest proportion of their wireless revenue on wireless infrastructure, followed by T-Mobile, Verizon, and Sprint.

- Net adds: Who’s been adding the most customers lately? It’s T-Mobile, followed by Tracfone, AT&T, Verizon, then Sprint. Sprint is the only carrier who’s been showing a net loss of customers.

- ARPU: Average Revenue Per User is tricky to report. Verizon doesn’t report ARPU anymore; they report Average Revenue Per Account. T-Mobile reports Average Billings Per User. Changes in the way the carriers are subsidizing handsets will also change how other carriers report their average revenue numbers.

- Churn: The churn rates of the Big Four are within 1.5% of each other. Sprint has the most at just above 2%, followed by T-Mobile around 1.5%, and AT&T and Verizon are tied at about 1%.

- Smartphone sales: Even though the data is patchy and incomplete, it’s still obvious that we’re now in the smartphone age. For all Big Four carriers, 90% or more of postpaid sales were for smartphones.

They’ll be updating this page regularly, so visit it each quarter.

Plastic, metal and glass: the upsides and downsides of materials used to build mobile devices

Click the photo to read the article.

AnandTech is my go-to site for solid, detailed, analyses of mobile hardware and software, and here’s one reason: their recent article, Discussion on Material Choices in Mobile, analyzes the pros and cons of plastic, metal, and glass, the materials used to build smartphone bodies.