Monday the 16th seems like a good day to reflect on Google’s Friday the 13th purchase of DoubleClick for $3.1 billion in cash. People are already calling this tie-up a nightmare for Microsoft (rumored to be the jilted suitor for DoubleClick’s affections). Is the story really that gory for Microsoft (and, for that matter, Yahoo!, AOL, and everyone else going toe to toe with Google), or is Google bleeding money for no good reason?

What makes sense about this deal? Combining the dominant provider of auctioned keyword, search-based cost-per-click (CPC) advertising with the leading vendor of traditional web ads sold on a cost-per-thousand (CPM) impression basis. Others have pointed out that both companies bring a wealth of behavioral data together, with the assumption that Google’s eggheads can sprinkle some science stuff around to focus display ad targeting.

Google was bound to get into the display ad business, and rumor had them building their own ad serving technology. As BusinessWeek notes, while Google’s stronghold in search has been the hotness in internet advertising, it still accounts for a minority of the total online ad market.

Paid search advertising will account for more than 40% of the $19.5 billion expected to go to online advertising this year, according to a Mar. 7 eMarketer report. Google grabs about two-thirds of the search advertising market. Much of that growth has stemmed from the ability of search engines to find consumers who have demonstrated an interest in a certain product.

Display advertising, which is often broken up by the medium, has not been as vibrant as search in recent years. In an October report, eMarketer put the display advertising number at $3.34 billion for 2006 and expected it to grow to $4.5 billion by 2010. Meanwhile, paid search advertising accounted for $6.76 billion of online ad spending in 2006 and was projected to grow to $10.3 billion by 2010.

In other words, search may be growing, but it isn’t the whole internet advertising story. Just as Google purchased YouTube to get a seat at the table of the internet video ad game, owning DoubleClick gives them an entrée into the display and rich media advertising the big brands love.

There are two major sets of customers in the internet ad game: publishers and advertisers. All of the internet ad companies try to serve both, but nobody’s equally good at playing both sides of the game. DoubleClick’s business is advertiser-heavy: selling software as a service to agencies and major brand advertisers, allowing them to control their campaigns across multiple sites. They’ve been working towards a cross-channel story for advertisers (banner, rich media, email, search and performance marketing), but (like everyone else) they’re not there yet. DoubleClick is a Frankenstein’s monster of channel-specific technology. Their secondary business is serving the publisher market, allowing destinations to manage their ad inventory. Google + DoubleClick combines the #1 seller of keywords to advertisers with one of the largest sellers of display and rich media to advertisers (although aQuantive might dispute that). From the advertiser’s perspective, Google becomes a one stop shop for most of the online advertising enchilada.

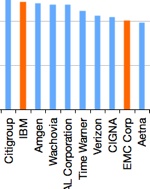

Nevertheless, this is an eye-popping multiple to sales, regardless of the strategic sense the deal makes. Reports I’ve seen have DoubleClick generating an estimated $300 million in revenue for 2006. DoubleClick’s major rivals, however, are reporting some pretty big numbers themselves: ValueClick at $545 million, aQuantive reported $442 million, and even my erstwhile corporate masters at 24/7 Real Media booked $200 million for the same period. None of these are perfect comparables; 24/7 runs an ad network and aQuantive owns an agency, two lines of business that DoubleClick has either jettisoned or shunned. So with these other companies still in play, is this really Armageddon for Microsoft’s ad business (and why isn’t anyone talking about how this deal is Bad, Bad News for Yahoo!? Surely YHOO + DCLK would have been a story Terry Semel would have enjoyed telling).

That’s what mystifies me about all this. I get that Google wanted to ace Microsoft, Yahoo!, AOL and others out of acquiring an asset like DoubleClick, with their combination of relationships with both advertisers and publishers. But why can’t Microsoft take a drive across town to visit aQuantive (hypothetically speaking, of course)? They could even swing a deal where they spin off the agency part of the business (Avenue A/razorfish) to one of the major ad agency holding companies and, hey-presto, they’ve subsidized their acquisition of a very competitive advertiser-side display ad business (and one with good advertiser relationships). Armageddon averted.

Dollars aside for a second, buying DoubleClick made sense for anyone trying to establish broad leadership in the online ad business, including Google. But you can’t lay that price aside for more than a few moments in this case—$3.1 billion is positively vertigo-inducing. Google has a mountain of cash, and will be adding to that pile at a furious rate, but Microsoft is more than their equal in that regard. Moreover, there are good assets still around to be had.

Blowing nearly 30% of your cash stash on a single deal had better bring more than just increased speed to market—it should be a knockout blow to the competition.

Technorati Tags:

Microsoft, Google, DoubleClick, advertising, aQuantive, 24/7 Real Media, ValueClick

Hey, something to watch while on the elliptical machine on Monday morning:

Hey, something to watch while on the elliptical machine on Monday morning: